How Many Credit Cards Should You Have in 2025?

Managing credit wisely is more important than ever, and one of the most common questions consumers ask is: how many credit cards should you have in 2025? The answer isn’t one size fits all it depends on your financial goals, credit history, and lifestyle. In today’s digital age, having the right number of credit cards can help you build a strong credit score, maximize rewards, and improve financial flexibility. However, too many credit cards can lead to overspending, missed payments, and unnecessary fees. This guide will walk you through the key factors to consider when deciding how many credit cards are ideal for you in 2025.

Introduction to Modern Credit Card Usage

Changing Landscape in 2025

As financial technology evolves and rewards programs become more competitive, the number of people holding multiple credit cards continues to rise. In 2025, managing plastic wisely has become an essential part of modern personal finance.

Rise in Cardholders and Options

Banks and fintech companies are offering diverse options from cashback and travel cards to crypto rewards and green credit cards making it more tempting than ever to apply for more than one.

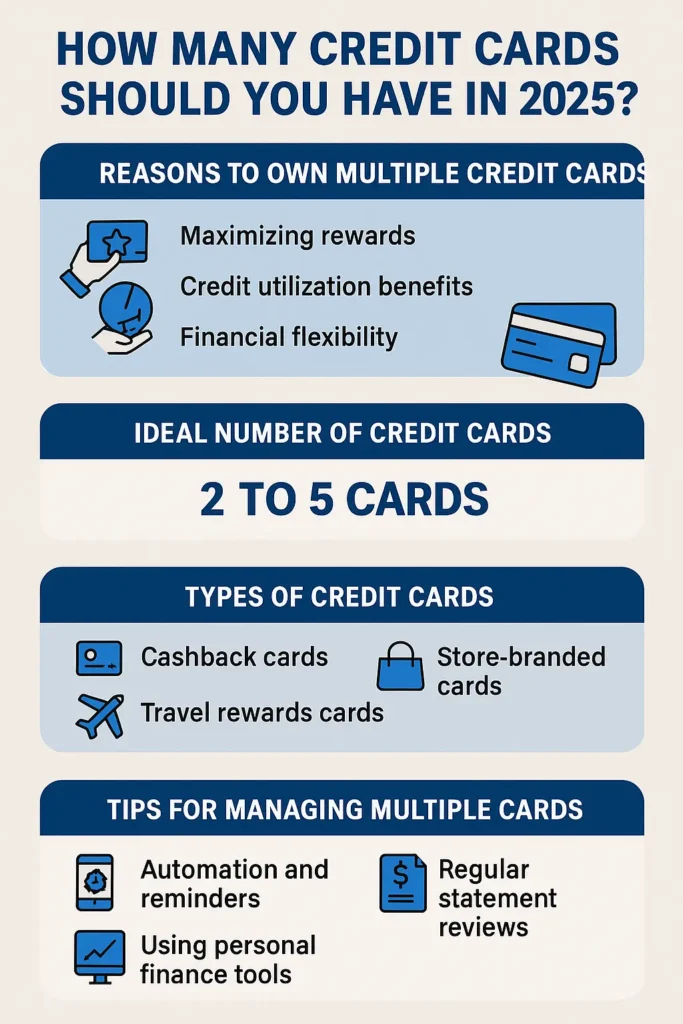

Why People Own Multiple Credit Cards

Maximizing Rewards

Each card serves a different purpose. For instance, a cashback card is great for groceries and gas, while a travel rewards card earns points for flights and hotels. By using multiple cards strategically, consumers can maximize earnings.

Credit Utilization Benefits

More cards mean a higher overall credit limit, which can improve your credit utilization ratio—a major component of your credit score.

Financial Flexibility

With multiple cards, you’re less reliant on a single source of credit. This provides a cushion during emergencies or if one account is compromised.

How Many Credit Cards is Ideal in 2025?

Industry Recommendations

Financial advisors generally suggest holding 2 to 5 credit cards, depending on your ability to manage them responsibly.

Expert Opinions

According to NerdWallet and Experian, three well-chosen cards often strike the right balance between reward potential and credit score management.

Ideal Range

- Beginner: 1-2 cards

- Intermediate: 3-5 cards

- Advanced user: 6+ cards (with excellent credit habits)

Pros and Cons of Having Multiple Credit Cards

Pros

Cons

Types of Credit Cards to Consider

| Card Type | Best For |

| Cashback Cards | Everyday purchases |

| Travel Rewards Cards | Frequent travelers |

| Store-Branded Cards | Loyal retail customers |

| Balance Transfer Cards | Managing high-interest debt |

Factors to Consider Before Applying

- Income level and employment status

- Spending patterns (e.g., travel, dining, groceries)

- Existing debt and payment history

- Short-term vs long-term financial goals

Credit Score Impact of Multiple Cards

Utilization Rate

Keep credit usage below 30% of your total limit for an optimal score.

Payment History

Late payments across any card can significantly damage your score.

Account Age

Opening new cards can reduce the average age of your accounts, a minor but notable factor.

Strategies for Managing Multiple Credit Cards

- Use automatic payments to avoid missed due dates

- Set reminders for statement reviews

- Track expenses using tools like Mint, YNAB, or Personal Capital

When Should You Add Another Card?

- You’re hitting the credit limit on current cards

- You want diverse rewards for new categories

- You’re eligible for a new customer bonus

When Should You Close a Credit Card?

- Annual fees outweigh the benefits

- You’re not using it anymore

- Terms or interest rates change negatively

Note: Closing an old account can impact your credit age, so choose your options carefully.

Common Myths About Credit Card Ownership

- Myth: More cards automatically lower your credit score

Truth: Only poor management hurts your score - Myth: Carrying a balance improves your score

Truth: Paying in full is always better

Case Studies and Real-Life Scenarios

Minimalist User – 2 Cards

Uses one no-annual-fee cashback card and one store card for regular purchases. Keeps things simple with automated payments.

Rewards Optimizer – 6 Cards

Uses different cards for dining, travel, groceries, business expenses, and balance transfers. Tracks them via a budgeting app.

Related Financial Entities and Tools

- Credit Card Issuers: Chase, American Express, Capital One, Discover

- Monitoring Tools: Credit Karma, Experian, TransUnion

- Educational Platforms: Investopedia, NerdWallet

Frequently Asked Questions

Conclusion

So, how many credit cards should you have in 2025? There’s no one-size-fits-all answer. A balanced mix to your financial habits, credit history, and spending goals is key. Whether you hold 2 or 6, managing them responsibly is what truly matters. You can also read debit vs credit card to understand difference between them.