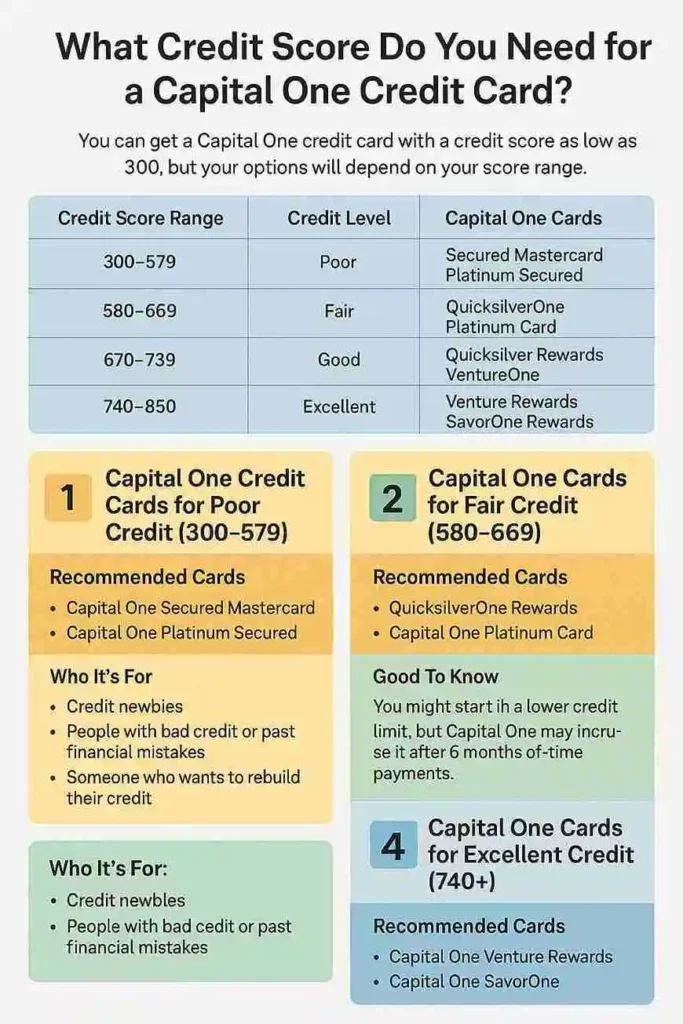

What Credit Score Do You Need for a Capital One Credit Card?

Thinking about applying for a Capital One credit card but not sure if your credit score is high enough? Don’t worry you’re not alone. Capital One offers a wide range of credit cards for all types of credit scores, from beginners to people with excellent credit.In this article, we’ll break down what credit score you need to get approved, plus which Capital One cards match your credit profile.

💡 Quick Answer :You can get a Capital One credit card with a credit score as low as 300

Credit Score Range Details

| Credit Score Range | Credit Level | Capital One Cards to Consider |

|---|---|---|

| 300 – 579 | Poor | Secured Mastercard, Platinum Secured |

| 580 – 669 | Fair | QuicksilverOne, Platinum Card |

| 670 – 739 | Good | Quicksilver Rewards, VentureOne |

| 740 – 850 | Excellent | Venture Rewards, SavorOne Rewards |

Let’s dive a little deeper.

Why Credit Score Matters

When you apply for a credit card, Capital One checks your credit report to decide if you’re a good match for the card. A higher score tells them you’re good at managing debt, which makes you less risky as a borrower.

Here’s what they typically look at:

- Your payment history (do you pay on time?)

- How much debt you have (credit utilization)

- Length of your credit history

- Recent credit applications (too many = bad sign)

- Types of credit used (loans, credit cards, etc.)

Capital One Credit Cards for Poor Credit (300–579)

If your credit score is low or you’re just starting out, don’t worry. Capital One has a few good starter cards.

✅ Recommended Cards:

- Capital One Secured Mastercard

- No annual fee

- You make a refundable security deposit

- Great for building credit

- Capital One Platinum Secured

- Helps improve your score with on-time payments

- Reports to all 3 credit bureaus

Who It’s For: Credit newbies

People with bad credit or past financial mistakes

Someone who wants to rebuild their credit

Capital One Cards for Fair Credit (580–669)

If your credit is improving or you’re in the “fair” zone, you’ve got more options.

✅ Recommended Cards:

- QuicksilverOne Rewards

- Earn 1.5% cash back on all purchases

- $39 annual fee

- Designed for fair credit

- Capital One Platinum Card

- No annual fee

- No rewards, but a solid credit builder

Good To Know: You might start with a lower credit limit, but Capital One may increase it after 6 months of on-time payments.

4. Capital One Cards for Excellent Credit (740+)

With excellent credit, you get access to Capital One’s top-tier cards.

✅ Recommended Cards:

- Capital One Venture Rewards

- 2x miles on every purchase

- Generous welcome bonus

- Travel insurance + Global Entry/TSA PreCheck credit

- Capital One SavorOne

- 3% cash back on dining, groceries, entertainment, and streaming

- No annual fee

- Perfect for foodies and families

Why It Matters: With higher scores, you can expect bigger credit limits, lower interest rates, and better

Use the Capital One Pre-Approval Tool

Not sure where you stand? Use the Capital One pre-approval tool before you apply. It gives you a list of cards you may qualify for with no impact on your credit score.

👉 Check Pre-Approval Now: https://www.capitalone.com/apply/credit-cards/preapprove/

What If You’re Not Approved?

If you apply and get denied:

- You’ll receive a letter explaining the reason

- Review your credit report for errors

- Work on building your score (pay bills on time, reduce balances)

- Consider a secured card or wait 3–6 months to try again

You can even call Capital One’s customer service to ask about the denial and next steps. Customer Service: 1-877-383-4802

Frequently Asked Questions

Final Thoughts

So, what credit score do you need for a Capital One credit card? The answer depends on the card. Capital One makes it possible to get started with a low score and grow with them over time.

No matter your current score, there’s likely a Capital One card that’s right for you. Just be honest on your application, know your score ahead of time, and use your card wisely once you get it.

Key Takeaways:

- Capital One offers cards for all credit scores

- Use their pre-approval tool to avoid guesswork

- Start where you are and build credit for better cards later