What Is a Billing Cycle and How Does It Affect Your Payments?

Understanding your credit card billing cycle is essential for managing your payments and avoiding interest charges. A billing cycle is the period between statements when your transactions are recorded and your balance is calculated. Knowing how it works helps you plan payments, track spending, and maximize your grace period. In this guide, we’ll explain what a billing cycle is, how it affects your due dates, and why staying on top of it can help you avoid late fees and improve your credit health.

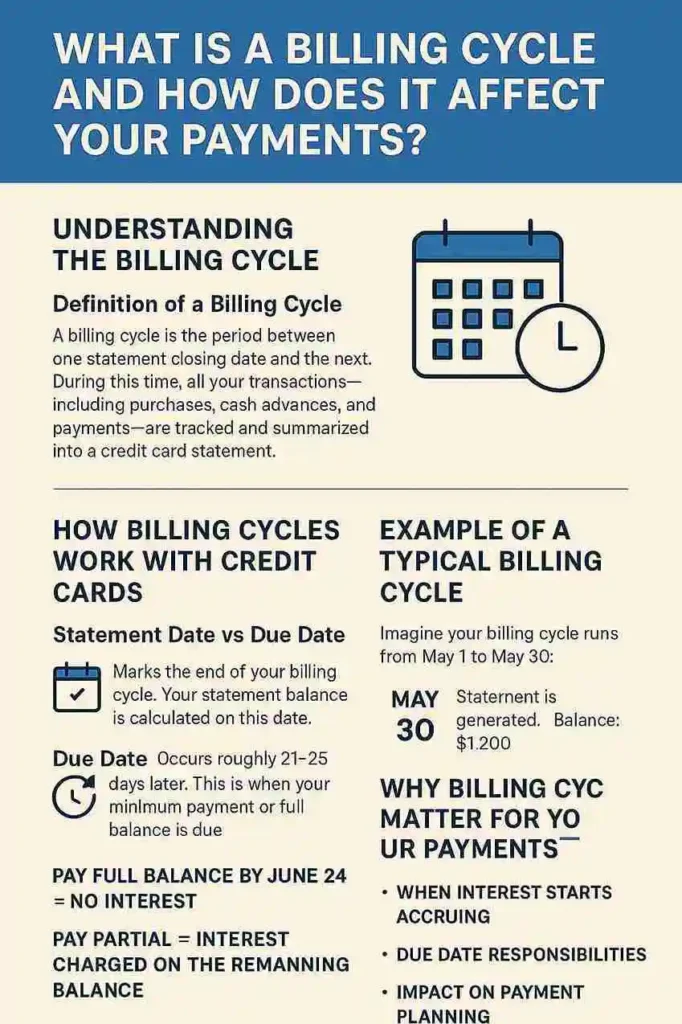

Understanding the Billing Cycle

Definition of a Billing Cycle

A billing cycle is the period between one statement closing date and the next. During this time, all your transactions including purchases, cash advances, and payments are tracked and summarized into a credit card statement.

Standard Cycle Lengths

Most billing cycles range from 28 to 31 days, depending on your credit card issuer. Some allow customization to align with your paycheck schedule.

Start and End Dates

The start date begins after your last statement was issued, while the end date is when your new statement is generated. The amount due from this cycle must be paid by the due date to avoid interest.

How Billing Cycles Work with Credit Cards

Statement Date vs Due Date

- Statement Date: Marks the end of your billing cycle. Your statement balance is calculated on this date.

- Due Date: Occurs roughly 21–25 days later. This is when your minimum payment or full balance is due.

Role of the Grace Period

The grace period is the time between your statement date and due date. If you pay your full balance within this window, no interest is charged on purchases.

Purchase Tracking

All purchases made during the billing cycle appear on that month’s statement, unless they’re made right at the cutoff, in which case they roll over to the next.

Example of a Typical Billing Cycle

Imagine your billing cycle runs from May 1 to May 30:

- May 30: Statement is generated. Balance: $1,200

- June 24: Payment due date

- Pay full balance by June 24 = No interest

- Pay partial = Interest charged on the remaining balance

Why Billing Cycles Matter for Your Payments

When Interest Starts Accruing

If you don’t pay the full balance by the due date, interest begins to accrue from the purchase date, not the due date.

Due Date Responsibilities

Missing your due date can trigger late fees, interest charges, and even a penalty APR.

Impact on Payment Planning

Knowing your billing cycle helps you schedule payments for cash flow efficiency and to avoid late charges.

Billing Cycle and Interest Charges

Full Balance vs Partial Payment

- Pay full: Retain grace period, no interest

- Pay partial: Interest is charged on the unpaid portion

What Happens If You Miss the Due Date

You lose your grace period and start paying interest on new purchases immediately.

Impact on Credit Reporting and Score

How and When Balances Are Reported

Most issuers report balances to credit bureaus on the statement date, not the due date.

Utilization Calculation Timing

High balances at the statement date even if paid later can raise your credit utilization ratio, potentially lowering your credit score.

Managing Payments Within the Billing Cycle

When to Pay for Optimal Credit Score

Paying before the statement date can result in a lower reported balance, helping improve your score.

Benefits of Early Payment

- Avoid interest

- Reduce utilization

- Free up credit for emergencies

Auto-Pay Strategy

Set up automatic payments for at least the minimum due and use reminders for manual full payments.

Changing Your Billing Cycle Date

How to Request Changes

Call your issuer or request online to change your billing cycle, especially if your current one clashes with your income schedule.

Aligning Cycle with Payday

This ensures you always have funds available and reduces the chance of missed payments.

Issuer Flexibility

Most major issuers like Chase, American Express, and Capital One allow you to shift your cycle date.

Billing Cycle vs Statement Period vs Grace Period

| Term | Description |

|---|---|

| Billing Cycle | Tracks transactions from start to end date |

| Statement Period | Same as billing cycle; used to issue the bill |

| Grace Period | Time between statement and due date with no interest |

Tips to Stay on Top of Your Billing Cycle

- Always know your statement and due dates

- Use calendar alerts

- Track via apps like Mint, YNAB, or Credit Karma

- Request text/email reminders from your issuer

Frequently Asked Questions

Conclusion

Your billing cycle is more than just a date range it’s the foundation of how and when you’re charged, how your credit score is impacted, and how you manage your monthly budget. Understand it, align it with your financial habits, and use it to your advantage to avoid interest and build credit effectively.