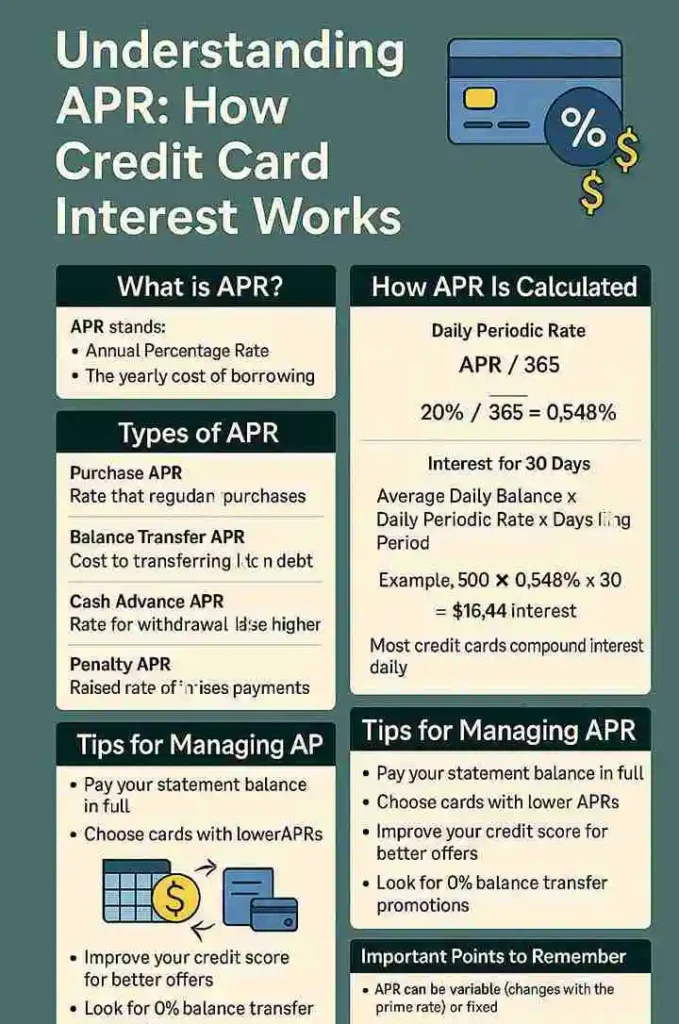

Understanding APR: How Credit Card Interest Works

If you use a credit card, knowing how credit card interest works is crucial to managing your finances effectively. The Annual Percentage Rate (APR) is the rate lenders charge when you carry a balance from month to month, and it directly impacts the cost of borrowing. This guide will help you understand what APR means, how it’s calculated, and how it influences your credit card payments. By gaining a clear understanding of how credit card interest works, you’ll be better equipped to make informed financial decisions, avoid unnecessary debt, and take control of your credit.

What is APR?

APR vs Interest Rate

APR stands for Annual Percentage Rate, and while it’s often used interchangeably with interest rate, they’re not quite the same. APR includes the interest plus any applicable fees, offering a more comprehensive view of your borrowing cost.

Meaning of Annual Percentage Rate

It’s the yearly cost of borrowing money expressed as a percentage. For credit cards, it’s the rate you’re charged if you carry a balance beyond the grace period.

Types of APR in Credit Cards

Purchase APR

The most common type it applies to purchases made with your credit card if you don’t pay the full balance each month.

Balance Transfer APR

Charged on debt moved from one card to another. Some cards offer 0% introductory APR for a limited time.

Cash Advance APR

This rate is typically higher and starts accruing immediately—there’s no grace period for cash advances.

Penalty APR

Triggered by missed payments or violations of terms, this APR can jump to 29.99% or more and stay there indefinitely.

How Is APR Calculated?

Daily Periodic Rate

APR is broken down into a daily rate:

java

CopyEdit

Daily Rate = APR ÷ 365

For a 20% APR:

sql

CopyEdit

20 ÷ 365 = 0.0548% per day

Formula with Example

If you carry a $1,000 balance for 30 days at 20% APR:

bash

CopyEdit

$1,000 × 0.000548 × 30 = $16.44 interest

Compounding Interest Explained

Most credit cards compound interest daily, meaning you pay interest on both the principal and accumulated interest.

How Credit Card Companies Use APR

When Interest Is Charged

Interest kicks in only if you carry a balance past your due date. If you pay your statement balance in full, you’re typically not charged interest.

Grace Periods

Usually 21–25 days from the end of your billing cycle. If used well, you can avoid interest entirely.

Variable vs Fixed APR

- Variable APR fluctuates with the prime rate.

Fixed APR remains the same but is rare in today’s credit card market.

How APR Affects Your Monthly Payments

Interest on Carried Balances

Even small balances can grow fast. For example, $2,000 at 22% APR can accrue over $400 in annual interest if not managed.

Cost of Minimum Payments

Paying the minimum may keep your account in good standing but extends the repayment period and increases the total interest paid.

What Is a Good APR in 2025?

Average APRs in the Market

As of 2025, average APRs range from 16% to 28%, depending on your credit score and card type.

What to Aim For

- Excellent credit: under 17% APR

- Fair credit: 20–24%

- Poor credit: 25%+

How to Lower Your Credit Card APR

- Negotiate with issuers – Especially if your credit has improved

- Improve your credit score – Better scores get better offers

- Use balance transfer offers – Look for 0% intro APR promotions

APR and Your Credit Score

Indirect Effects

APR doesn’t directly affect your score, but high interest rates can lead to growing balances, increasing your utilization ratio, which lowers your score.

Common APR Mistakes to Avoid

- Ignoring terms and conditions

- Making minimum payments only

- Taking cash advances without knowing the cost

- Triggering penalty APRs

Tools to Help Manage APR

- NerdWallet APR calculator

- Mint – for tracking balances and due dates

- Credit Karma – for viewing APRs and credit offers

- Experian Boost – helps improve scores to get better APRs

Frequently Asked Questions

Conclusion

Understanding APR is essential to using credit cards wisely. It’s not just about avoiding fees, it’s about maximizing your financial health. Pay balances in full, avoid high-interest situations, and use the right tools to monitor your APR. A little awareness goes a long way in saving you money and building strong credit.